Can credit repair really raise your score?

Credit repair firms make promises they can't keep

In a recent Consumer Federation of America survey, more than half of all respondents thought credit repair firms were a legitimate way to improve a credit score. In reality, nothing could be further from the truth.

What these firms typically do -- and this was very common last decade -- is use a technique to temporarily raise your score by a significant number of points for just a few weeks before it plummets back down again. But the credit bureaus have gotten wise to this technique over the years.

Anyone who says they can magically eliminate bad items on your credit report is telling you a big lie. Keep your money in your own pocket and don't give it to them for their supposed "services"! Better yet, use it to pay the debts you owe and that will improve your credit score on its own.

Know that there is no magic wand for credit repair. If you need help, get in touch with the National Foundation for Credit Counseling. But if you understand these basics and put them into practice in your life, your credit score will rise slowly but surely.

Raise your credit score with this knowledge

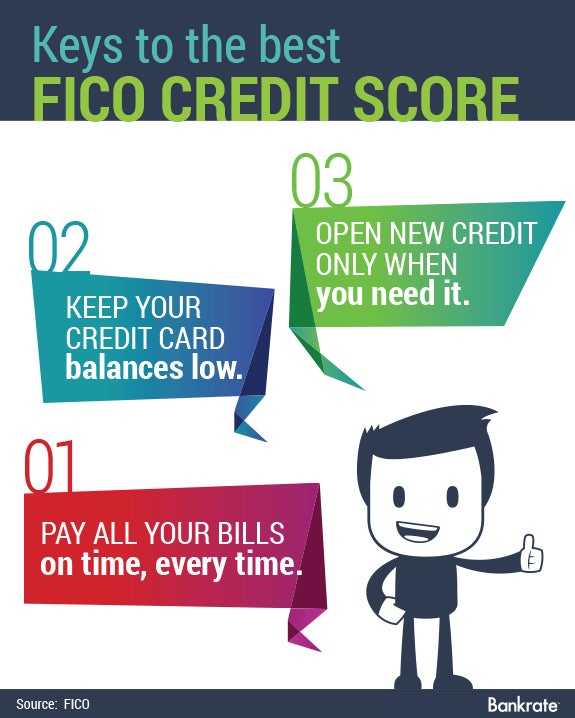

If you're suffering from poor credit, there are several surefire ways to get your credit healthy again. Follow these tips and you'll be well on your way:

- Always pay your bills on time and pay down the total amount you owe.

(accounts for 35 percent of your score)

If you forget all else after reading this, remember this one! This is the single most important rule for having a good credit score. - Keep a low credit utilization rate.

(accounts for 30 percent of your score)

Let's say you have a credit card with a $10,000 limit. If you're carrying a balance month-to-month of $3,000, you're only using 30 percent of the total limit. But if your credit limit is suddenly dropped to $3,000, then suddenly you're using 100 percent of what's available to you. That's yet another reason to always pay down credit card debt as quickly as possible. You always want to stay at credit utilization of 30 percent or less. - When you pay off a credit card, don't close the account.

(accounts for 15 percent of your score)

Doing so only reduces your available credit and drives your score down. You want to have between four to six lines of credit. Be sure to use them twice a year -- even if it's just for a dollar store purchase -- and pay them off right away. That will keep them active in your credit mix.

If you're facing a huge new annual fee on a card that has a zero balance, try "leapfrogging." That's my term for using the 45-day window you have before any new terms of service go into effect to shop around. So once you get notice about a new annual fee, start looking around for other no-fee credit cards. Submit your application and once you get your new no-fee card, then go ahead and shut down the original one that wanted to spring a fee on you.

The remaining 20% of your credit score is comprised of what types of credit make up your credit mix (10%) and how much new credit you have in your life and how quickly you took it on (10%).